Last updated: 20/11/2025

How Liberty Media Runs F1

When Liberty Media acquired Formula 1 (F1) in 2017, the championship was iconic but commercially outdated. The previous leadership relied on exclusivity, limited digital presence, and a shrinking audience. In less than a decade, Liberty Media transformed the sport into an entertainment powerhouse worth over $20 billion.

This article breaks down how they did it – through modern media strategy, demographic rebuilding, and a complete overhaul of the F1 business model.

The $8 Billion Bet: How Liberty Media Took Control

- Enterprise value: $8.0 billion

- Equity value: $4.4 billion

After the acquisition, Liberty rebranded the division as the Formula One Group and immediately restructured the sport’s governance.

Commercial vs Regulatory Separation

This separation is crucial to the modern F1 business model:

- Formula One Group (Liberty Media): controls all commercial revenue (media rights, sponsorship, race promotion).

- FIA: governs technical rules, sporting regulations, and safety.

Under Bernie Ecclestone, both sides were intertwined, limiting innovation. Liberty Media’s clean split gave them unrestricted room to execute a new F1 commercial strategy, making the sport more attractive to investors, brands, and global markets.

The Strategic Pivot: From Scarcity to Accessibility

Under Ecclestone, the sport operated like an exclusive club, tight media control, minimal digital presence, and resistance to engaging younger fans.

Liberty Media flipped the philosophy entirely.

Digital Liberalization

- Teams and drivers were allowed to post behind-the-scenes content.

- Short-form media restrictions were relaxed.

- F1 embraced social platforms, memes, onboard videos, and real-time engagement.

This shift created the foundation of modern F1 marketing, turning drivers into digital personalities and massively expanding reach.

Immediate Commercial Upside

By opening up the ecosystem:

- F1 became the fastest-growing sport on social media in Liberty’s first three years.

- Global fanbase grew to 826.5 million by 2024.

- A larger audience gave Liberty leverage to raise media rights and sponsorship prices.

Liberty’s bet was simple:

Grow the audience first → monetize it later.

And it worked.

The Drive to Survive Effect

Netflix’s Drive to Survive (DTS) was the narrative engine behind F1’s demographic revolution.

How DTS Transformed the Audience

- Average viewer age dropped from 44 → 32.

- Female fan share rose from 32% → 42% (2018–2025).

- 43% of fans are now under 35.

This shift is a marketer’s dream: young, global, responsive to storytelling, and extremely brand-friendly.

The U.S. Explosion

Thanks largely to DTS:

- U.S. audience reached 52 million

- Multiple U.S. races were added

- 2025 U.S. media rights renewal is expected to be a record-breaking bidding war

No other motorsport has achieved this level of pop-culture penetration.

Monetizing Momentum: The Financial Engine Behind Liberty’s F1

The results of Liberty’s strategy show up clearly in the numbers.

Revenue Growth (2017 → 2024)

- $1.8 billion → $3.41 billion (91.2% increase)

Media Rights Fees

- 2017: $606.6 million

- 2024: $1.18 billion

Media rights are now F1’s largest income stream, fueled by the sport’s expanded audience.

Race Promotion Fees

Global demand for races has never been higher. Long-term deals run deep into the 2030s (Miami through 2041), supporting stable year-to-year growth.

Event “Festivalization”

Liberty turned races into three-day entertainment events. “Other F1 Revenue” (hospitality, experiences, VIP packages) more than doubled.

Attendance for the first 14 races of 2025:

- 3.9 million, up from 2.6 million in the 2018 benchmark.

Vertical Integration: The Las Vegas Experiment

The Las Vegas Grand Prix represents Liberty’s boldest move. Instead of licensing race promotion, Liberty invested $500 million directly into the event.

This means F1 keeps:

- Ticket revenue

- Hospitality revenue

- Local sponsorship

- Branding rights

This model dramatically increases profit potential and could become standard for select marquee events.

The Concorde Agreement & Franchise Protection

The Concorde Agreement governs revenue sharing, budget caps, and long-term stability.

Key elements include:

1. Budget Cap

Introduced to improve competitive balance and financial sustainability.

2. Prize Money Equalization

Teams now receive more stable revenue, reducing the gap between giants and midfield teams.

3. Anti-Dilution Fee

New teams must pay a large entry fee to protect the value of existing franchises.

- Originally: $200 million

- Current expected level (e.g., Cadillac/Andretti): $450 million

This ensures F1 teams function like high-value modern sports franchises.

Valuation Conflicts and the $20 Billion Question

In 2023–2024, rumors circulated of a $20 billion acquisition bid for F1 – a massive jump from the $8 billion valuation at purchase.

The FIA pushed back publicly, expressing concerns about “inflated valuations” affecting ticket prices and hosting fees. Liberty Media responded strongly, warning that public comments about a listed company could harm investors.

This clash highlights a core truth: Liberty Media runs F1 as a global entertainment asset first – and a sport second.

Conclusion: The Unstoppable Formula

Liberty Media’s ownership of Formula 1 is a masterclass in modern sports business.

By shifting from exclusivity to global accessibility, embracing digital storytelling, expanding into key markets, and professionalizing the commercial structure, Liberty rebuilt the entire F1 ecosystem.

The result is a younger, larger, more diverse global fanbase – and a sport that generates record-breaking revenue while positioning itself for long-term growth.

F1 is now more than a racing series. It’s a vertically integrated global entertainment brand with momentum that shows no signs of slowing.

FAQ

What is the difference between Liberty Media and the FIA?

Liberty Media (Formula One Group) manages all commercial business – media rights, sponsorship, and race promotion. The FIA handles governance, rules, safety, and sporting regulations.

How much did Liberty Media pay for F1, and what is it worth now?

They acquired the sport for $8 billion in 2017. Its estimated valuation today is around $20 billion.

How did Drive to Survive impact the sport?

It expanded the global audience, reduced the average viewer age, increased female participation, and massively accelerated U.S. growth.

How does F1 make money under Liberty Media?

Through media rights fees, sponsorships, race promotion fees, VIP hospitality, and vertically integrated events like the Las Vegas GP.

Recent Posts

-

How to Become an F1 Driver?

-

Will Kalle Rovanperä Drive in Formula 1?

-

How Do F1 Car Reveals Work? 2026 Launch Dates

-

Why Formula 1 Is More Attractive to Brands Than Ever

-

F1 Fitness Explained: How Physically Demanding Is Formula 1 for Drivers?

-

Ferrari Driver Academy: From Karting to Formula 1

-

2026 F1 Power Unit Changes Explained: What the New Regulations Mean for Formula 1

-

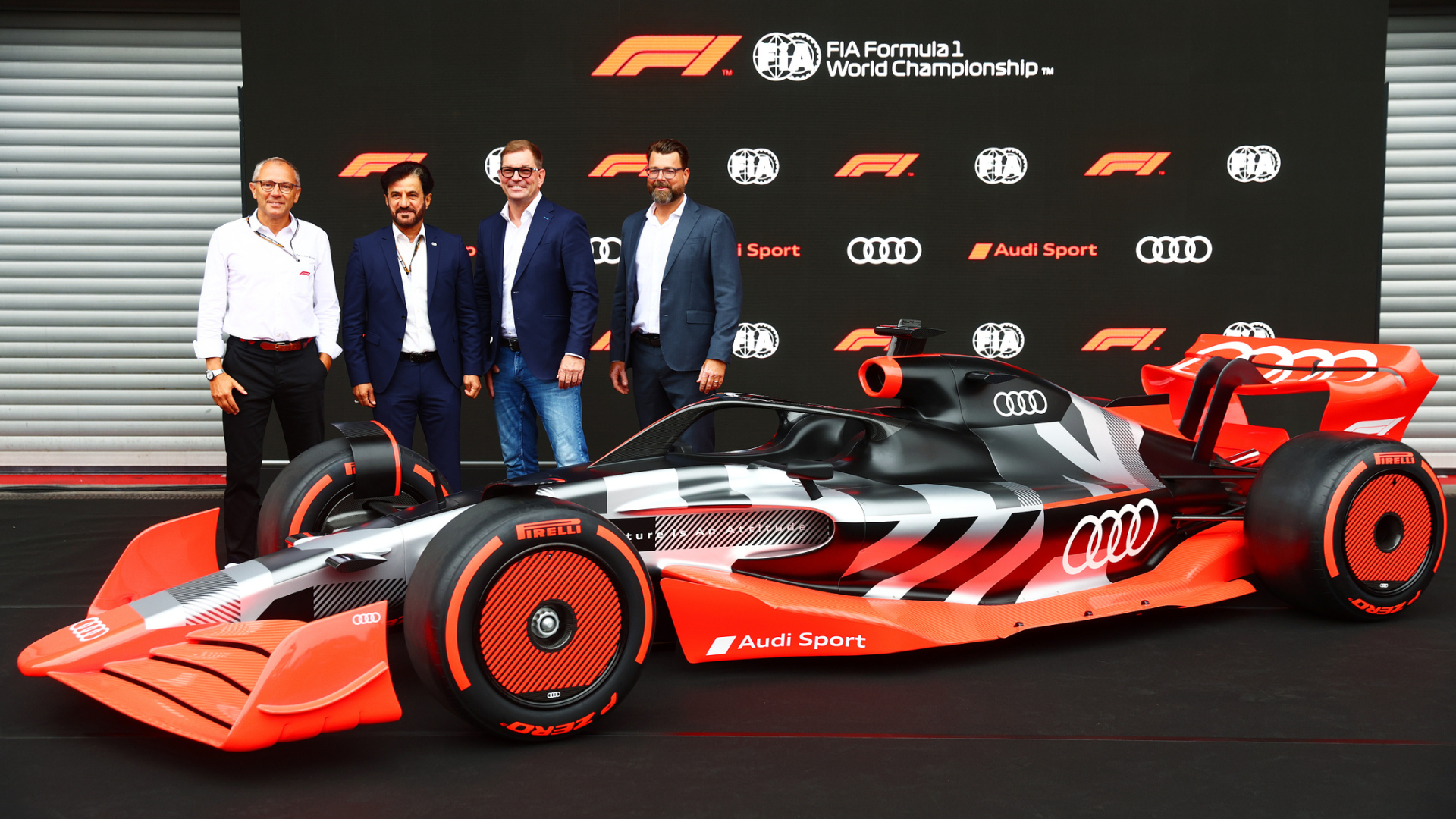

Sauber F1 Team History Overview (1970-2025): From Independent Constructor to Audi Operation

-

Audi F1 Team: Full Overview of the German Manufacturer

-

Why Ford Is Joining Formula 1 With Red Bull From 2026